Cybersecurity VC Forgepoint opens in Europe to address growth funding gap (Preqin)

Grant Murgatroyd

November 11, 2024

- News

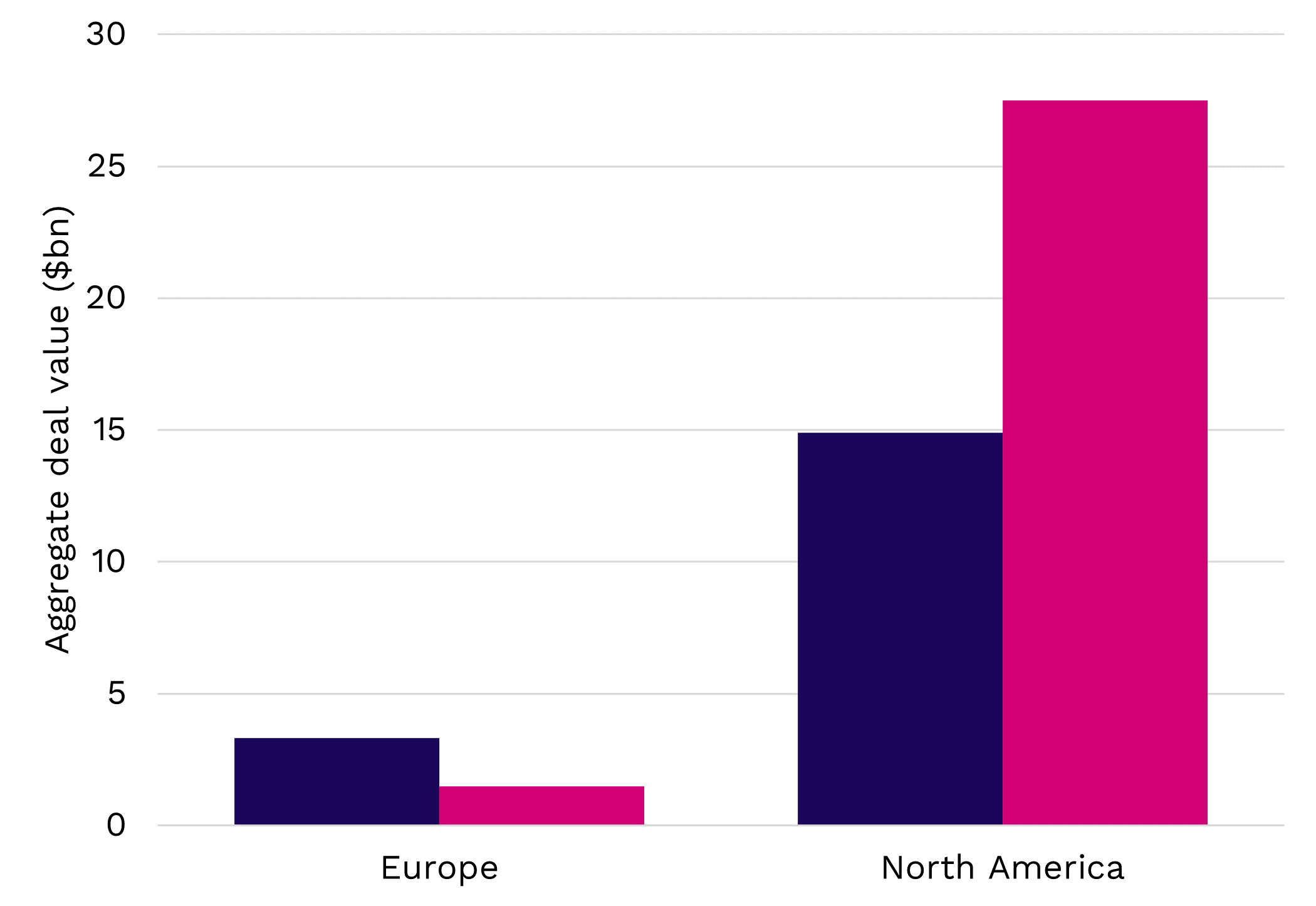

European cybersecurity firms have attracted $1.5bn in late-stage investment since 2019, compared with $27.5bn invested in North America

(Update: The headline and first two paragraphs of this story have been updated to more accurately describe Forgepoint’s investment strategy.)

November 12, 2024 (Preqin News) – California-based Forgepoint Capital, a venture capital firm focused on cybersecurity, AI, and infrastructure software has chosen London as a base for its international operations. The firm has established a new management company, Forgepoint Capital International (FPCI), and entered a strategic alliance with Banco Santander.

Founded in 2015 by Alberto Yépez and Don Dixon, Forgepoint raised $306mn for its debut fund, Forgepoint Cybersecurity Fund I, and $450mn for its second fund in 2019, with both funds closing above target. The firm launched a third fund in 2022.

Yépez started his career at Apple in the 1980s, and then founded enCommerce and led it to a sale to Entrust, where he was Co-CEO up to a sale to Thoma Bravo, and was also CEO of Thor Technologies, which was bought by Oracle. He worked as a VC investor at Trident Capital with Dixon, before the pair founded Forgepoint.

‘I believe private equity and venture capital investment has become a specialized sport,’ Yépez told Preqin News. ‘I remember being at a prior firm where somebody was doing edtech, someone else solar, someone early stage, someone else – growth. Other guys were talking about EBITDA. It became very clear that, given the dynamics and the importance of cybersecurity, we needed to spin out and focus on it. Specialization is how you create an ecosystem of people that can ground your investment theses, give you proprietary access to deals, and provide value creation with company building skills.’

Yépez says that some investors were initially skeptical about the narrow focus: ‘When we started going to market in 2015/16, LPs asked if we could really build a multi-fund franchise just on cybersecurity. But the world has changed. LPs are looking for alpha and a specialized fund, regardless of whether it’s cybersecurity or healthcare or something else, it becomes a differentiator and a key enabler of growth.’

While Forgepoint is focused on a single sector, it is large, fast-growing, and mission-critical. Research firm Gartner predicts worldwide end-user spending on information security will rise 15.1% in 2025 to $212bn. ‘The continued heightened threat environment, cloud movement, and talent crunch are pushing security to the top of the priorities list and pressing chief information security officers to increase their organization’s security spend,’ said Shailendra Upadhyay, Senior Research Principal at Gartner.

FCPI will use London as base for expansion into Europe, Latin America, and Israel. The team will be led by Managing Director Damien Henault, Partner Michael Cortez, and Chief Financial Officer Jaime Goyarrola.

Forgepoint has backed several cybersecurity companies in Europe, including AlienVault (acquired by AT&T), Constella Intelligence, BehavioSec (acquired by LexisNexis Risk Solutions), Lynx Technologies, and ReversingLabs. ‘Core to our success as we expand to Europe leveraging our institutional platform is that we’re specialized. We have already partnered with the other specialized funds in Europe and now we have that scale-up ability,’ said Yépez.

The firm has also entered a strategic alliance with Banco Santander that will see the Spanish bank invest up to €300mn in the London management company, in Forgepoint’s third fund, and alongside it as a co-investor. It plans to launch an international fund in 2025.

‘Europe has exceptional academic and research centers,’ Henault told Preqin News. ‘In terms of R&D and pure IP production, which is key for deep tech, AI, and cybersecurity, there’s a growing pool of investable companies and a lot of talent. We’re in Europe to find the talent and help them realize the commercial potential at scale in the region and then globally.’

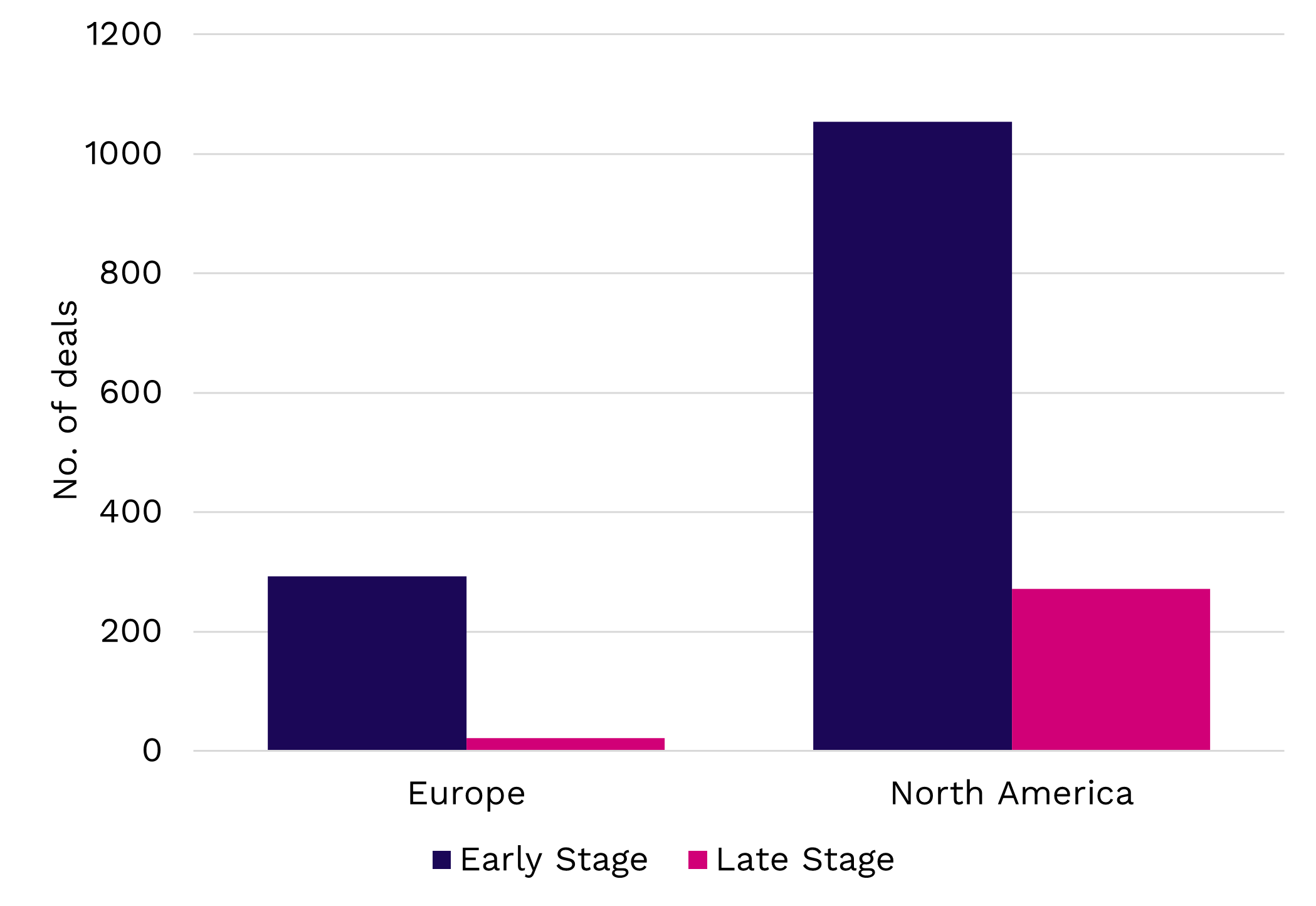

Forgepoint has identified a particular shortage of scale-up capital and funding for later-stage rounds in the cybersecurity sector in Europe. Preqin has recorded 293 early-stage rounds (up to and including Series B) in Europe since 2019 and only 22 later-stage cybersecurity rounds. In value terms, $3.3bn was invested in early-stage companies and $1.5bn in later stage.

This is in sharp contrast to North America, where there were 1,054 early-stage cybersecurity deals with an aggregate value of $14.9bn and 271 later-stage deals with a total value of $27.5bn.

Europe’s late-stage deal deficit

Value ($bn) and number of early- and late-stage* cybersecurity deals, 2019–2024 YTD

Source: Preqin Pro. Data as of November 2024

* ‘Early stage’ means deals categorized as Seed, Series A, and Series B. ‘Late stage’ is Series C or later. Deals where the round was not specified have not been included, though most are small and likely to be early-stage.

Henault is optimistic the firm will be able to hit the ground running: ‘The fact that we have a European hub opens the door to a number of government-backed entities who have a mandate to find strategic investment partners, which is critical with cybersecurity and the growth of AI. There are a number of small, early-stage specialist firms at the local level creating national champions. We can help them bridge the gap to become regional champions and take them to what may be ultimately their largest end market, the US.’

The opinions and facts included within the above do not constitute investment advice. Professional advice should be sought before making any investment or other decisions. Preqin providing the information in this content accepts no liability for any decisions taken in relation to the above.